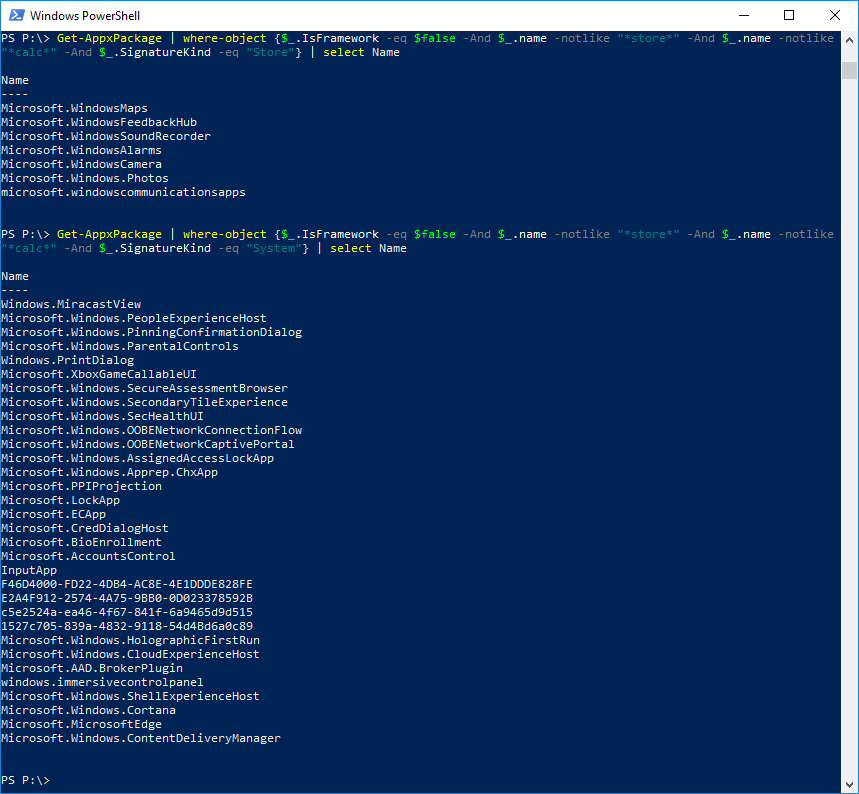

Based on https://community.spiceworks.com/topic/1408834-removing-windows-10-apps-gpo, with the additional refinement of a filter that removes only Store apps and not system apps or frameworks, using PowerShell:

1. List the apps that would be uninstalled.

The -AllUsers flag requires an elevated PowerShell run on an administrator account. Omit the -AllUsers flag if running as a nonadministrator for the current user.

Get-AppxPackage -AllUsers | where-object {$_.IsFramework -eq $false -And $_.name -notlike "*store*" -And $_.name -notlike "*calc*" -And $_.SignatureKind -eq "Store"} | select Name

On a 1711 newly installed VM, this resulted in this list:

Name ---- Microsoft.MicrosoftOfficeHub Microsoft.Microsoft3DViewer Microsoft.ZuneVideo Microsoft.WindowsMaps Microsoft.WindowsFeedbackHub Microsoft.BingWeather Microsoft.Messaging Microsoft.MicrosoftStickyNotes Microsoft.XboxIdentityProvider Microsoft.XboxSpeechToTextOverlay Microsoft.Print3D Microsoft.GetHelp Microsoft.WindowsSoundRecorder Microsoft.Getstarted Microsoft.WindowsCamera Microsoft.3DBuilder Microsoft.Xbox.TCUI Microsoft.People Microsoft.RemoteDesktop Microsoft.XboxGameOverlay Microsoft.Office.Sway Microsoft.Windows.Photos Microsoft.MSPaint Microsoft.SkypeApp Microsoft.XboxApp Microsoft.DesktopAppInstaller Microsoft.WindowsAlarms Microsoft.OneConnect Microsoft.Wallet Microsoft.ZuneMusic Microsoft.Office.OneNote microsoft.windowscommunicationsapps Microsoft.MicrosoftSolitaireCollection

2. Actually uninstall them.

Get-AppxPackage -AllUsers | where-object {$_.IsFramework -eq $false -And $_.name -notlike "*store*" -And $_.name -notlike "*calc*" -And $_.SignatureKind -eq "Store"} | Remove-AppxPackage

Certain apps that cannot be uninstalled might be listed in the output.