It’s generally an honour to be appointed to serve as the head of a federal agency. After the revelation this morning that President-elect Trump will nominate a S&C partner to head the Securities and Exchange Commission, the whole law firm’s website appears to be down because of the increased interest:

Encryption = lines of code on screen

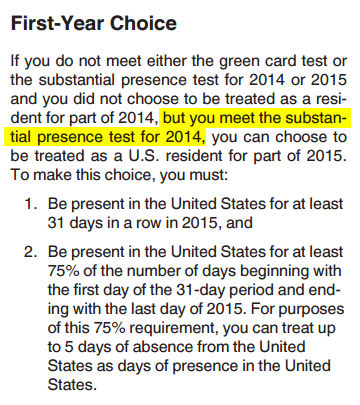

Pretty sure the IRS made a typo in Publication 519

There’s a provision that allows aliens in the U.S.[1] to choose to be treated as a U.S. resident for tax purposes even if they would not otherwise qualify as a resident. Income tax rules themselves are already really confusing — and they are even more complicated for foreigners in the U.S. — so a typographic error could really confuse a taxpayer.

I think the IRS made a typographic error, but I’m not even sure how to get in touch with them to fix this.

Motivating example

Suppose you arrive in the U.S. for the very first time on October 1, 2015 to work for the foreseeable future on a TN-1 (NAFTA Professional) visa. Because the period from 2015-10-01 to 2015-12-31 is insufficient to meet the Substantial Presence Test,[2] you would otherwise be a nonresident alien for tax year 2015. This would mean your income in the United States might be subject to taxation in the U.S. as well as in your home country. What if you wanted to be treated as a resident alien starting on October 1, 2015 — despite not satisfying the Substantial Presence Test?

This is the First-Year Choice, and it’s documented in Publication 519 (“U.S. Tax Guide for Aliens”) by the IRS.

The error

I got a little confused when I first read the rule, because it seemed to require an impossibility:

Let me excerpt that to show why it’s so self-contradictory: “If you do not meet either the [GCT] or the [SPT] for 2014 … but you meet the [SPT] for 2014.”

Huh? Clearly they meant 2016 there. Moreover, if you met the SPT for 2014, the current tax year — 2015 — wouldn’t be your first year in the U.S.

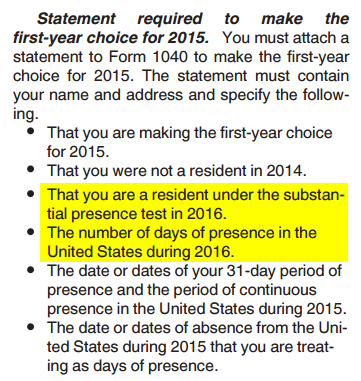

This is confirmed by the bulleted list on the following page:

Motivating example resolved

If you are going to satisfy the Substantial Presence Test in the following tax year — 2016 — you can choose to pretend to be a U.S. resident from 2015-10-01 to 2015-12-31 as well, if you meet all of the requirements in the bulleted list above.

Footnotes

| 1 | ↑ | Foreigners, not extraterrestrials. |

|---|---|---|

| 2 | ↑ | The Substantial Presence Test (SPT) requires, in its simplest form, at least 183 days of physical presence within the United States in a three-year period. |

Renewing date of departure by physical presence in Canada

TL;DR many Canadians in the US have more ways to vote, even under the 5-year limit, than previously thought.

A week ago, I mailed in my special ballot to Elections Canada. I can now say I’ve voted in the 2015 Canadian federal election!

There’s been a lot of discussion among Canadians at HLS, and folks in the Harvard Graduate Student Canadian Club, about the logistics of voting in this election. Notably, while most of them don’t have to deal with having a green card (as I do), some grad students may question how the 5-year limit applies to them.

Letters from Elections Canada, sent to two students who emailed them to inquire about logistics, support two conclusions.

1. Voting physically in Canada still possible

Voters who have been living abroad for 5 consecutive years or more and who are not exempt from the 5 year limit may vote in person at the advance polling station or the regular polling station corresponding to an address for which they have a proof of address (they cannot vote by special ballot).

– Elections Canada, in response to Peter W[1]

The provisions of the Canada Elections Act that prohibit registering to vote by mail from abroad after five years only apply to the special ballot. If you are a Canadian who has been a nonresident for more than five years, apparently you can still vote in person. (Canadian news has reported instances of people successfully using this “loophole.”) Advance voting days are October 9–12, conveniently during Canadian Thanksgiving and Columbus Day in the US.

2. Fluid definition of residency—unlike taxation and immigration

Thank you for your email … in which you requested information for students who have been living outside for more than five years. There is no differentiation between student voters abroad and non-student voters abroad; the five-year rule remains the same.

I would like to take this opportunity to clarify that there is no minimum period of time that an elector must have been in Canada in order to be considered as having resided there. It is based on where you consider your home address to be and the date of departure is based on the last day you consider yourself having lived in Canada.

– Elections Canada, in response to Peter W[2]

“Residing” has been interpreted here in the most liberal way possible by Elections Canada. It’s as though they are trying to preserve the broadest scope of voting rights possible in light of the Court of Appeal for Ontario ruling. (Good for them!)

The paragraphs quoted provide the basis for this interpretation:

Any instance of physical presence in Canada can be enough to renew your date of departure if you considered yourself to have lived in Canada during that stay.[3]

Elections Canada is not asserting an objective test of residency. They are not inquiring into whether the U.S. Department of Homeland Security treats you as a resident alien. They do not care when you became a nonresident for tax purposes on the CRA’s books.

So, in my interpretation, the following example set of facts satisfies their criteria and entitles the citizen to register to vote by special ballot (critical facts highlighted):

- Alice is a Canadian citizen.

- Alice is 23 years old.

- Alice ordinarily lives in a rented apartment in Cambridge, MA.

- Alice attends HLS on an F-1 student visa.

- Alice started studying in the U.S. on an F-1 visa 6 years ago, since August 2009.

- Alice intends to return to live and work in Canada after graduation.

- Alice last lived in the Trinity-Spadina riding in Toronto, ON, before becoming a student in the U.S.

- Alice last visited her parents on September 1, 2015, at that same residence in Toronto, for one day. She left on September 2.

- Alice does not consider any other place to be her permanent place of abode.

- Alice considered herself to have lived in Canada during that day. (remember, “no minimum period of time” is necessary)

- Alice is a temporary resident outside Canada for fewer than five years, and may register to vote by special ballot with a departure date of September 2, 2015.

For an alternative hypothetical, see footnote 4.[4] Remember that these are only predictions of eligibility.

TL;DR many Canadians in the US have more ways to vote, even under the 5-year limit, than previously thought.

Again, just a reminder: I’m not a lawyer (yet). Don’t take this as legal advice. Do take it as the opinion of someone who believes the right to vote is constitutionally guaranteed to all Canadian citizens, and who wouldn’t mind seeing this tested in a legal challenge.

Footnotes

| 1 | ↑ | Posted on Facebook in the HLS Canadians 2015–2016 group. |

|---|---|---|

| 2 | ↑ | Second paragraph is substantially identical in a separate response to Jacob Q. |

| 3 | ↑ | There is a textualist reading of the statute that supports this interpretation, based on the term “consecutive,” which would be interrupted by stays in Canada. See Canada Elections Act, S.C. 2000, c 9, § 222(1)(b) (applying the five-year limit to those “residing outside Canada for less than five consecutive years”). |

| 4 | ↑ | Bob is a 22-year-old Canadian citizen, who works in New York City on post-completion OPT on an F-1 visa after graduating from a 4-year undergraduate in the U.S. Prior to his undergrad, Bob lived with his parents in Markham and considers this to be his home address in Canada. He has been in his F-1 status for 62 months, and is considered a US resident alien for tax purposes. Bob visited his girlfriend in downtown Toronto for a week during the summer, living at her apartment there. Bob intends to return to Canada upon the expiration of his F-1 visa. Bob may register to vote by special ballot in the Markham—Unionville riding, using the departure date following his stay during the summer. |

How should Internet regulation of content work?

I first published the following query in a closed discussion forum for CIS 125/LAW 613 (Technology & Policy) at Penn Law. It is reposted here with minor edits.

Understanding the layers of the Internet (TCP/IP, etc) helps us to think about Internet governance in terms of allocating scarce resources, such as IP addresses and domain names. There is another layer to regulating the Internet that has little to do with scarcity or technical concerns: content on the World Wide Web. While people around the world effectively must agree to the same technical standards and the same mechanisms of allocating scarce resources in order for the Internet to function, there seems to be disagreement on which laws relating to speech and content apply, the geographic boundaries (if any) within which they apply, and to what extent foreign entities must comply. These concerns are obvious when we talk about the “Great Firewall of China”, highlighted by Google’s pull-out from mainland China, but less so evident when talking about countries that don’t use technical measures to censor citizens’ Web access.

This week, the issue became topical when Russia’s media/telecom regulator clarified existing rules on use of an individual’s image, seeming to outlaw certain forms of the Internet phenomenon known as memes.[1] The clarification came on the heels of a Russian court ruling in favour of a singer whose likeness was used without his permission in various Internet memes, some of which were unflattering. According to the Roskomnadzor—the agency that issued the clarification—as reported by the Washington Post, it is illegal in Russia to depict a public figure in a way that is unrelated to their “personality”, whatever that should mean. As expected, American media quickly seized on this act as part of a broader effort to control dialogue on the Web, at least within the Web as seen in Russia; noncompliance with the agency’s rules can result in a website being blacklisted in all of Russia.[2]

Setting aside any immediate visceral reaction that categorizes this as censorship, we might pause to consider Roskomnadzor’s justification, which pointed to the offence to celebrities’ “honor, dignity and business.”[3] But this is not some novel argument to protect celebrities at the expense of open expression; after all, even US law, which is weaker than European regimes that acknowledge a dignitary right in privacy, protects one’s likeness and privacy to some extent in tort, for very similar reasons.[4] And even if we disagree with the application of this principle in the agency’s rule, protecting individuals’ privacy and identity is still a legitimate state interest.

The real question, I think, is not whether Russia’s rule accomplishes the right balance of priorities, between privacy/control-of-likeness and open expression. After all, the extent to which the rule can even be enforced is dubious. (It would be a waste of resources for the Russian government to go after every meme of Putin on horseback.)

The much more interesting question for us is, to what extent should geopolitical nations be able to control content on the global Web according to their own sovereign laws? Moreover, given the borderless (by default) accessibility of websites and the diverse origins of Web publishers, is it reasonable to burden companies across the world with the task and cost of complying with a patchwork of nation-by-nation rules and judicial orders lest they allow their site to go dark in Pakistan or Russia or China?

In other contexts, like inconsistent cybersecurity laws across US states, companies have found it easiest to follow the strictest set of rules, hence simplifying their task. Maybe an image host like 9gag, catering to meme-makers, would find it technically easiest to comply with these inconsistent rules by deleting content whenever any nation complains. But then free speech everywhere is constrained to the narrowest rules among jurisdictions, so this is an unacceptable outcome. What is the alternative? Does the company have to add technical complexity to its systems to block Russian visitors only from accessing a picture of Putin? Isn’t this option economically inefficient?

Looking to a historical example, even a company that wants to stand up for human rights and free speech principles might find a weighty cost of defiance. In 2010, Google withdrew from operating the mainland Chinese edition of its search engine so as to relieve itself of the burden of obeying mainland Chinese regulations.[5] Reportedly frustrated with complying with strict censorship, and probably having small market share in the shadow of China’s Baidu, Google decided to redirect all mainland Chinese visitors to its Hong Kong edition, which operates under more lax rules. The cost of doing so? Losing relevance in the Chinese market.[6]

Many other companies lacking Google’s backbone and cash would likely roll over when requested to avoid losing their audience. Does this give too much influence to countries like the United States, China, and the UK, over what citizens can see on the Web? Is the Web any better under the rules of the superpowers than under the patchwork of nation-by-nation restrictions on free speech?

Footnotes

| 1 | ↑ | Megan Geuss, Russia’s Internet censor reminds citizens that some memes are illegal, Ars Technica (Apr. 11, 2015), http://arstechnica.com/tech-policy/2015/04/russias-internet-censor-reminds-citizens-that-some-memes-are-illegal/; Caitlin Dewey, Russia just made a ton of Internet memes illegal, Wash. Post Intersect Blog (Apr. 10, 2015), http://www.washingtonpost.com/news/the-intersect/wp/2015/04/10/russia-just-made-a-ton-of-internet-memes-illegal/. |

|---|---|---|

| 2 | ↑ | See Caitlin Dewey, supra note 1. |

| 3 | ↑ | Id. |

| 4 | ↑ | Restatement (Second) of Torts § 652A-E (1977). |

| 5 | ↑ | Jemima Kiss, Roundup: Google pulls out of China, Guardian (Mar. 23, 2010), http://www.theguardian.com/media/pda/2010/mar/23/google-china. |

| 6 | ↑ | See Kaylene Hong, Google’s steady decline in China continues, now ranked fifth with just 2% of search traffic, Next Web (Jul. 5, 2013), http://thenextweb.com/asia/2013/07/05/googles-steady-decline-in-china-continues-now-ranked-fifth-with-just-2-of-search-traffic/. |

Town of Greece v. Galloway

I’m in the middle of final exams, and I really don’t have the time for this, but I was blown away by the decision in Town of Greece v. Galloway, 572 US __ (2014).

As Justice Kagan wrote in her dissent,

“A person goes to court, to the polls, to a naturalization ceremony—and a government official or his handpicked minister asks her, as the first order of official business, to stand and pray with others in a way conflicting with her own religious beliefs. Perhaps she feels sufficient pressure to go along—to rise, bow her head, and join in whatever others are saying: After all, she wants, very badly, what the judge or poll worker or immigration official has to offer. Or perhaps she is made of stronger mettle, and she opts not to participate in what she does not believe—indeed, what would, for her, be something like blasphemy. She then must make known her dissent from the common religious view, and place herself apart from other citizens, as well as from the officials responsible for the invocations. And so a civic function of some kind brings religious differences to the fore: That public proceeding becomes (whether intentionally or not) an instrument for dividing her from adherents to the community’s majority religion, and for altering the very nature of her relationship with her government.”

Unsurprisingly, this case was again decided on a 5-4 split, with the conservative justices in the majority. As the New York Times reports, “For Justices, Free Speech Often Means ‘Speech I Agree With’”.

Jefferson on intellectual property

“Stable ownership is the gift of social law, and is given late in the progress of society. It would be curious then, if an idea, the fugitive fermentation of an individual brain, could, of natural right, be claimed in exclusive and stable property. If nature has made any one thing less susceptible than all others of exclusive property, it is the action of the thinking power called an idea, which an individual may exclusively possess as long as he keeps it to himself; but the moment it is divulged, it forces itself into the possession of every one, and the receiver cannot dispossess himself of it. Its peculiar character, too, is that no one possesses the less, because every other possesses the whole of it. He who receives an idea from me, receives instruction himself without lessening mine; as he who lights his taper at mine, receives light without darkening me. That ideas should freely spread from one to another over the globe, for the moral and mutual instruction of man, and improvement of his condition, seems to have been peculiarly and benevolently designed by nature, when she made them, like fire, expansible over all space, without lessening their density in any point, and like the air in which we breathe, move, and have our physical being, incapable of confinement or exclusive appropriation. Inventions then cannot, in nature, be a subject of property. Society may give an exclusive right to the profits arising from them, as an encouragement to men to pursue ideas which may produce utility, but this may or may not be done, according to the will and convenience of the society, without claim or complaint from anybody.”

VI Writings of Thomas Jefferson, at 180—181 (Washington ed.), as quoted in Graham v. John Deere Co., 383 U.S. 1 (1966). Emphasis mine.

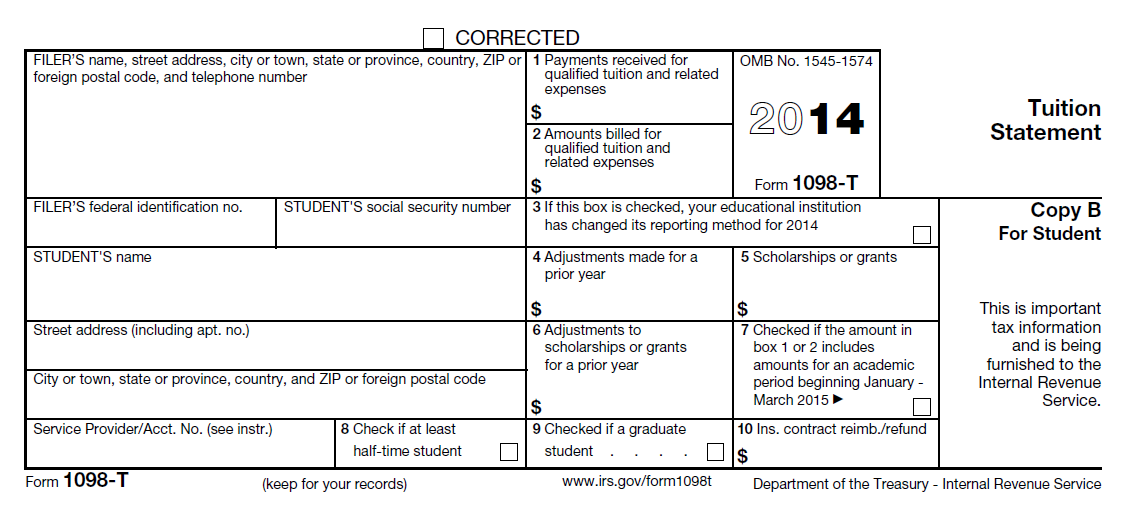

Form 1098-T: an example of international students’ special needs

I am not a tax attorney or tax consultant. This post was written while I was an undergraduate student at the University of Pennsylvania, and Co-Chair of the International Student Advisory Board.

IRS Form 1098-T, which educational institutions issue to students as a tuition statement for tax purposes, is used by many American families to claim educational credits or deductions on their federal tax returns.

Should international students have this form?

It’s complicated. In some situations, yes.

Universities often will choose not to issue this tuition statement to international students because those students can’t do anything with it. This is, however, an incorrect generalization.

Are international students able to use this form for anything?

Most international students are ineligible to claim those educational credits/deductions because they are nonresident aliens (e.g. F-1 student). These individuals would not benefit from having the 1098-T.

But some students, especially graduate students, may be eligible to claim credits/deductions because…

- they are resident aliens under the substantial presence test, usually because they have stayed in the United States for more than 5 years;

- they are nonresident aliens for immigration purposes, but resident aliens for tax purposes, maybe as spouses of American citizens or resident aliens; or

- they are nonresident aliens for both immigration and tax purposes, but eligible dependents of parents who are resident aliens/permanent residents/citizens; those parents are able to claim these credits in certain situations.

I am an international student in the above categories. Can I get a 1098-T from my school?

The IRS says that universities “do not have to file Form 1098-T or furnish a statement for… nonresident alien students, unless requested by the student“. Additionally, they are not required to provide it for “students whose qualified tuition and related expenses are entirely waived or paid entirely with scholarships”.

You must still meet all of the other requirements to get a 1098-T:

- Attend an eligible educational institution (college, university, vocational school, or other postsecondary educational institution in §481 of the Higher Education Act)

- Have paid qualified tuition and related expenses in that tax year

- i.e. tuition, fees, course materials required to be enrolled

- does not include room, board, insurance, medical expenses including student health fees, transportation, and personal/living/family expenses

- Receive credit for the completion of course work leading to a postsecondary degree, certificate, or other recognized postsecondary educational credential

- i.e. most undergraduate bachelors programs and graduate masters and PhDs qualify

- continuing education is often not included

- Be enrolled in any academic period of that tax year (consult IRS instructions for exceptions)

- Have provided your SSN or ITIN to the educational institution either through student records or an additional Form W-9S

What are some potential hurdles?

I was in a situation this year where my university did not issue me a 1098-T, and responded to my request with a form letter:

Does every Penn student receive a 1098-T?

Penn does not provide a 1098-T to non-resident aliens, or any student whose qualified charges are fully funded by grant, scholarship or tuition waivers, or any student who was enrolled in non-credit courses during the academic year.

They additionally stated,

“Though you might have received a 1098t form in the past, going forward as a Canadian citizen you will not receive one.”

As I’ve explained above in this post, this determination was a mistake. It conflates citizenship & immigration status with residency for tax purposes, and ignores the possibility that someone else other than me may be eligible to claim the credit.

Furthermore, even if I were a nonresident alien ineligible to claim the credit, nothing in the IRS regulations for Form 1098-T gives the educational institution the right, responsibility, or power to determine whether I might be eligible to claim the credit; nor does it permit them to deny a Form 1098-T to a nonresident alien’s request.

What does this situation reveal about international students?

First, on the superficial level, this situation reveals that immigration status and residency for immigration purposes differs from tax status and residency for tax purposes. Clearly, not all employees who handle these cases are aware of these stipulations.

More importantly…

International students are a large, diverse, and varied community. International students have complex needs based on their individual families’ statuses. It is a mistake to define broad, indiscriminate policies that treat all international students identically.

If you think I’ve made a mistake in this post, or wish to disagree with my conclusion here, I’d like to hear from you. Comment below or send me an email using the contact form.